Advertisement - Continue Reading Below

Advertisement - Continue Reading Below

The Pioneer Woman's Expanded Furniture Collection Is Now Available at Walmart

Advertisement - Continue Reading Below

Join the fun

Want more from The Pioneer Woman?

Get recipes, home design inspiration, and exclusive news from Ree right to your inbox!

Advertisement - Continue Reading Below

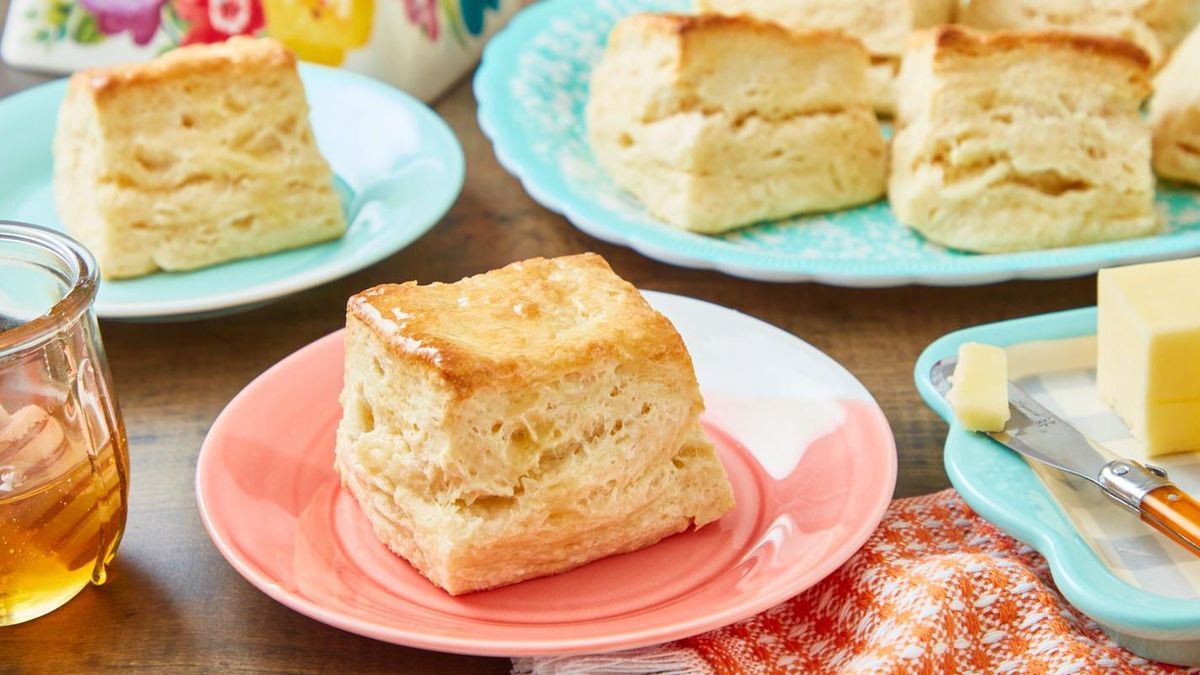

This Week's Top Recipes

Ree's Blog

2023澳洲幸运5开奖历史记录体彩-历史开奖查询 澳洲幸运5开奖直播官网、在线澳洲5查询网视频 From the Magazine

Shop Ree's Cute Magazine Cover Look Right Now

These Work Shoes for Women Are So Cute and Comfy

The Best Vintage-Inspired Swimsuits to Buy Now

Cute Floral Dresses to Wear All Season

Advertisement - Continue Reading Below

Let's Go Shopping

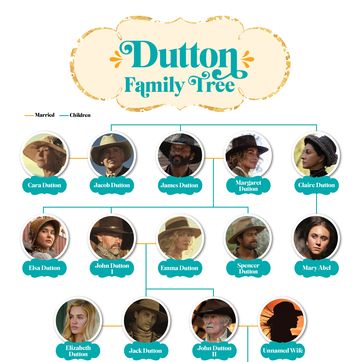

Entertainment News

Latest From The Pioneer Woman

These Healthy Appetizers Are Actually Good for You

Shop Epic Deals on Ree's Line During Labor Day

Is Walmart Open on Labor Day This Year?

Don't Miss Out on Walmart's Labor Day Sales

21 Unique Photo Gifts That Everyone Will Love

The Most Comfortable Stadium Seats for Game Day

50 Hiss-terical Cat Puns and Jokes

You Have to Try These Harvest Bowls for Lunch

Nothing Says Fall Like Butternut Squash Soup

How to Make Easy, Creamy Pumpkin Mac and Cheese

Pumpkin Spice Cake Is Heaven by the Slice