Roughly one year ago, I decided I wanted to lose weight. I had zero idea how I was going to do this, I only knew that I needed to start. After years of writing cookbooks, hosting a cooking show, owning a restaurant and bakery, and having a cooking website, the weight had crept up through the years and my exercise/activity level had all but slowed to a stop. With the exception of walking with the dogs, I had pretty much given myself permanent permission "not to have time" to exercise because of work, scheduling issues, and any other excuse I could come up with. So last January, at my highest weight ever and with the wedding of my daughter looming in May, I just knew I had to start.

One year later, I've lost 55 pounds.

I wrote a post last June, after I had lost 43 pounds, explaining the different ways I'd approached losing weight. Here is that post, in case you'd like to read the details. When I posted that article, I thought it would be the final recap, but in the seven months since, I wound up dropping some more weight and learning a few more lessons along the way. While I considered writing an update post last fall, I decided to let myself get to a year and make sure I felt solid about where I am. So here I am!

10 Things I've Learned About Losing Weight

First, to summarize the June post:

I didn't use a trainer, I didn't do Keto or Paleo or follow an official diet, I didn't eat specialty foods, and I didn't do intermittent fasting. Those things work for lots of people, which is wonderful! I just hadn't had success with them.

Here's what I did do:

I ate fewer calories.

I consumed smaller portions.

I weighed my food.

I walked and did the rowing machine.

I built muscle by lifting weights and doing lunges and squats.

I ate more protein, ate less sugar and drank no alcohol.

I used an app called Happy Scale to track my daily weight.

I switched to a standing desk and generally tried to stand and move more.

So here's what I've learned, one year later! (In no particular order.)

1. The initial, more intense, stage doesn't have to last forever.

I started my weight loss journey in January 2021 and went all-in for the first five months. After that initial stage of counting calories, lifting weights, etc., I relaxed my efforts a little bit beginning in the summer months. During those first five disciplined months, I'd developed a good sense of portion sizes, calorie amounts, and protein percentage, and I was able to go about daily life with a general sense of the choices I needed to make. If I ever had a question, I'd break out the food scale or Google the calories of a common food, but I generally put away the food scale last July and never looked back.

I was glad I'd been so strict for that first stage, because it wound up being a nice crash course that equipped me going forward. Starting out with that discipline actually allowed me more freedom later in the process.

2. Building muscle is the gift that keeps on giving.

I can't emphasize this enough: Building muscle—not just the smaller muscles in your arms, but the larger muscles in your legs and butt—will turbo charge your weight loss like nothing else and set you up for more success.

The months I spent doing squats, lunges, and dead lifts early in my weight loss process really laid the foundation for a summer and fall of more efficient calorie burning. I'm not a physician or trainer, but I can tell you that as I watched the number on the scale continue to decrease through the summer and fall, I knew without question that it was largely due to the muscle I'd built. It's like an engine that's always working behind the scenes! The great part about it is that you can have a day or two or three when you fall off track with eating or exercise, but if you have that strong foundation of muscle, you can climb right back on the bike and not feel (or see) the consequences as much.

3. My body is now accustomed to eating smaller portions.

One of the primary things I learned in the initial months of my weight loss was just how off the rails I'd been for years when it came to portion size! During the five-month period I weighed my food and counted calories, I really broke the spell of eating too much volume and during this process, I trained my body to get used to smaller—well, I should say more normal—portions. The answer "smaller portions" is so lackluster and boring when someone is asking me about losing weight, but it has absolutely held true for me. Today, as I point out below, I'm eating all the foods I love, but my body is satisfied with much less of it.

4. Alcohol, in moderation, is fine.

I knew I had to eliminate alcohol entirely during the initial/intense stage of my weight loss, but beginning in the summertime, I started having a social drink or two here and there. I avoided (and still avoid) anything that's sugary or otherwise really caloric. Off limits are frozen drinks such as daiquiris and margaritas, and sweet cocktails that include syrups and lots of fruit juice.

That said, lemon and lime juice are my friend when it comes to booze, and my two favorite drinks are Ranch Water (clear tequila, lime juice, and sparkling water over ice) and White Wine Spritzer (small amount of cold white wine, sparkling water, and lemon slices.) These sparkling water-spiked drinks are great for two reasons: First, they force you to hydrate as you ingest the alcohol or wine! Second, they keep you from drinking too much alcohol. They also spread out the calories more: In other words, you can have two drinks for the calories of one.

5. Moving every day, even if I don't exercise every day, is very important.

Starting in September 2021, when school and football started and I had lots of filming and cookbook events going on, I fell off my disciplined exercise routine a bit. I still did the rowing machine, lifted weights, and did Pilates, but I was exercising only two or three days a week, instead of the five or six days I was doing before. As I explained in #1 above, I had a good foundation of eating smaller portions and a rock solid (haha, just kidding...let's say firm) foundation of muscle, so fortunately this decrease didn't undo my hard work. However, I found that if I had a couple of days at home when I was sitting and working a lot, it showed itself both in the number on the scale and in the way I felt overall. So I made sure to stay more committed than ever to using my standing desk, stepping away for frequent breaks, and putting myself in a position to move more. Today, I'm still using a standing desk and not letting myself collect too much dust during the day.

Moving is good! (Essential, actually.)

6. It's important for me to weigh myself daily.

I realize this can be triggering for some, and I can't emphasize this enough: My decision to weigh myself every day is not about fixating over every pound and ounce. I've just found that when excess weight has crept on through the years, it has happened when I've chosen not to weigh myself. Before I decided to lose weight last January, I don't think I'd stepped on a scale for two years. I willfully hadn't weighed myself because I never wanted to know. Without seeing that number go up over time, it was easy for me to tell myself that it was probably just a few pounds. So part of my routine now is weighing first thing in the morning (before water, coffee, anything) and logging it in my now-favorite app called Happy Scale. 😊 It's good to see the trends over time! (As you'll read in my June post, Happy Scale was an incredibly helpful tool during the past year!)

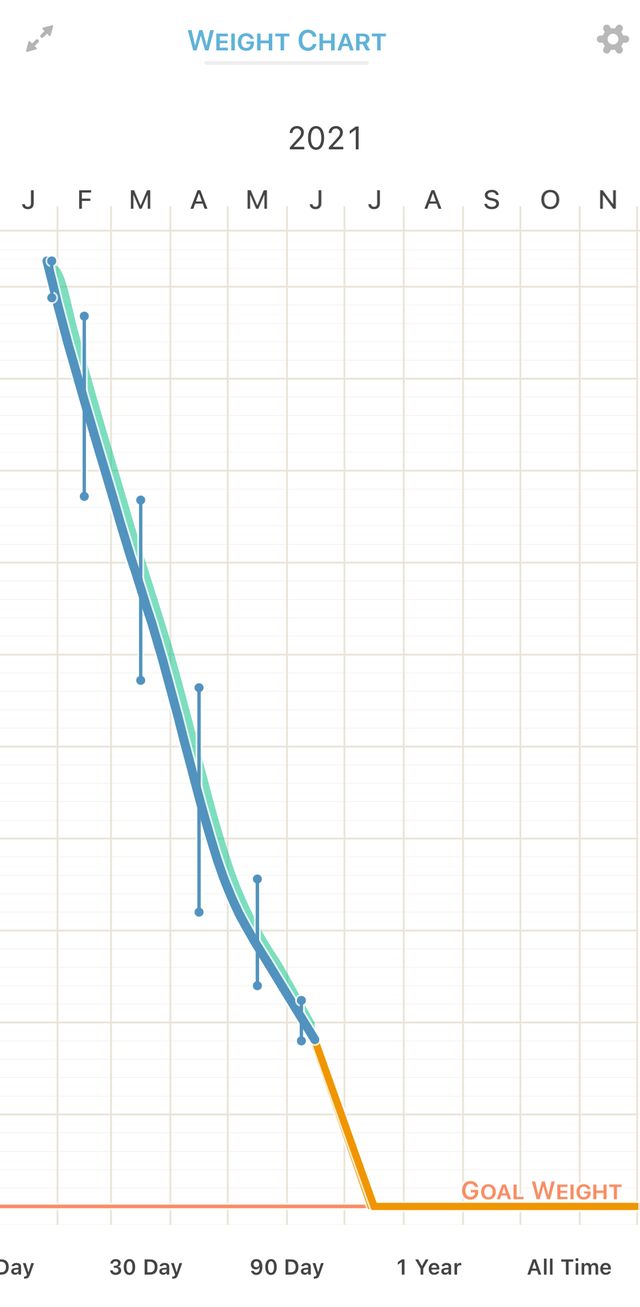

Here was my weight chart on Happy Scale from January 2021 to June of 2021.

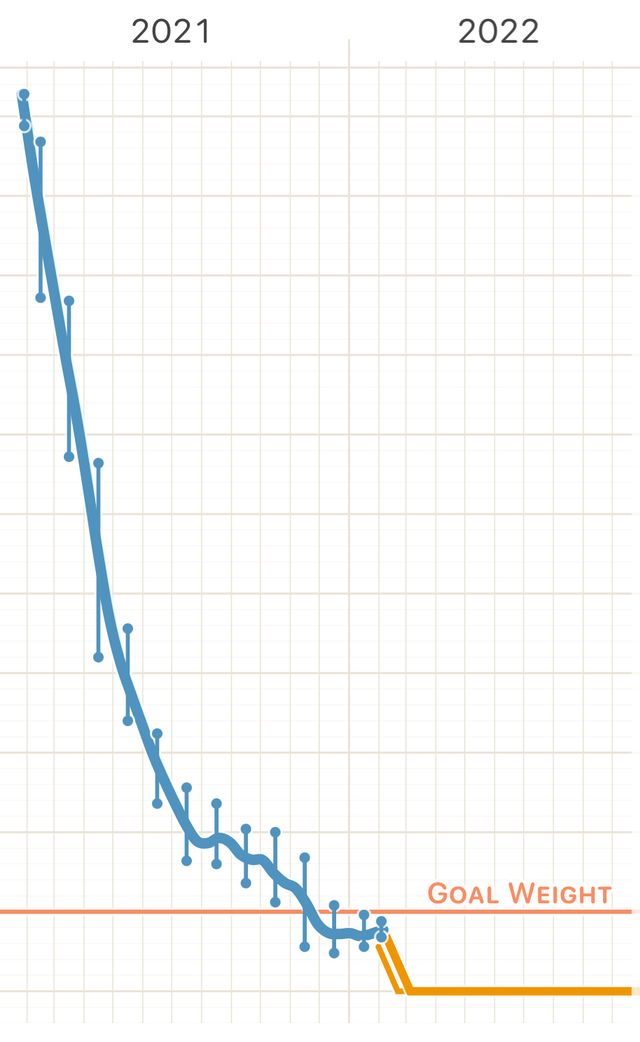

And here's a screenshot of the chart now, showing January 2021 to February 5, 2022.

You can see the intense, more aggressive period of weight loss in the first half of 2021, but you can also see how it slowly became more gradual through the summer and fall. And now, I'm settling in just below the original goal weight I imagined for myself—which, by the way, was intentionally realistic! I wasn't striving for pre-marriage, pre-baby, pre-thirties weight! 😊 Just a good weight where I thought I'd feel and look better, and where I felt I'd be able to maintain and have longer term success.

7. There's nothing on my list of banned foods!

During the first five months of my weight loss, I was more strict. I did not drink alcohol, and I largely stayed away from foods that had added sugar.

While I did eat small portions of all the foods my family was eating, I also ate a higher amount of high-protein foods such as egg whites, chicken, fish, lean beef, plain Greek yogurt, cottage cheese, Swiss cheese, and dark, leafy greens.

Now, a year later, I eat pretty much all the foods I love, with two big differences: First, my portions are much more reasonable. Second, I do still pay attention to the daily proportions I'm devoting to both high protein foods and foods with wasted calories. I'll carry this thought over into the next paragraph. (Oh! And a correction: Bananas are the one item on my list of banned foods. Ha!)

8. I try to minimize wasted calories.

I'm so grateful for that initial five months of nutritional boot camp I put myself through, because in addition to resetting my whole understanding of portion size, it also made me much more aware of wasted calories, and the importance of minimizing them as a percentage of my diet.

Foods that I consider wasted calories: sugary soft drinks, cookies, cake, potato chips, doughnuts, and the like.

In my June post, I gave this example: "If I am eating X calories today, do I want to blow 300 of those calories on a doughnut? Or do I instead want to spend 50 of them on a piece of good dark chocolate to get my fix, then keep eating things with more nutritive content?" Months later, I apply that thinking to all sorts of high-sugar, high-carb foods that don't have any nutritional value. Using the doughnut as an example, some days I eat half the doughnut. Some days I decide not to eat the doughnut. Other days I'll pinch off a bite of the doughnut. Heck, there will be a day now and then when I will eat the whole doughnut. There's no hard and fast rule, but I'm just more mindful of it now, and I try to factor the doughnut into the day as a whole. (In the old days, I might eat three doughnuts and not give it a thought. Ha.)

Another example I gave in my June post: I still eat chocolate cake; I just eat a Rhode Island sized piece instead of a Texas sized piece!

9. Steadily doing everything is so much more effective than going all-in on just one thing.

Looking back on the past year, I'm glad I started out pretty aggressively and had the wedding as an initial motivator, because it compelled me to tackle my weight loss from several different angles. I've been able to experience different approaches: building muscle, eating more protein, moving/standing more, exercising on the rowing machine, logging my daily weight, etc. I can continue all of these over time, or I can emphasize some more than others, or choose some over others. This has expanded my options and made me feel like I have more control over the inevitable ebbs and flows over time.

10. Losing weight and becoming healthy is a lifestyle change, but it hasn't changed my life. (Or has it?...)

There's something about the word "lifestyle change" that I have always resisted. I would hear people say "Losing weight is about changing your lifestyle" and I'd think, "But I don't want to change my lifestyle. I just want to wear smaller jeans." The phrase lifestyle change, to me, meant that one's day-to-day life would be totally different—and maybe unrecognizable? I think that's what always made me bristle .

Maybe it would be better to say perspective change instead of lifestyle change. Because that's what it has been for me. During the first five months (and in the ensuing months) of my journey, I experienced a seismic shift in my perspective of everything I've mentioned: Portion size, calories, daily movement, sitting vs. standing, protein percentage, muscle mass, wasted calories, and so on. I think about all of those things totally differently now.

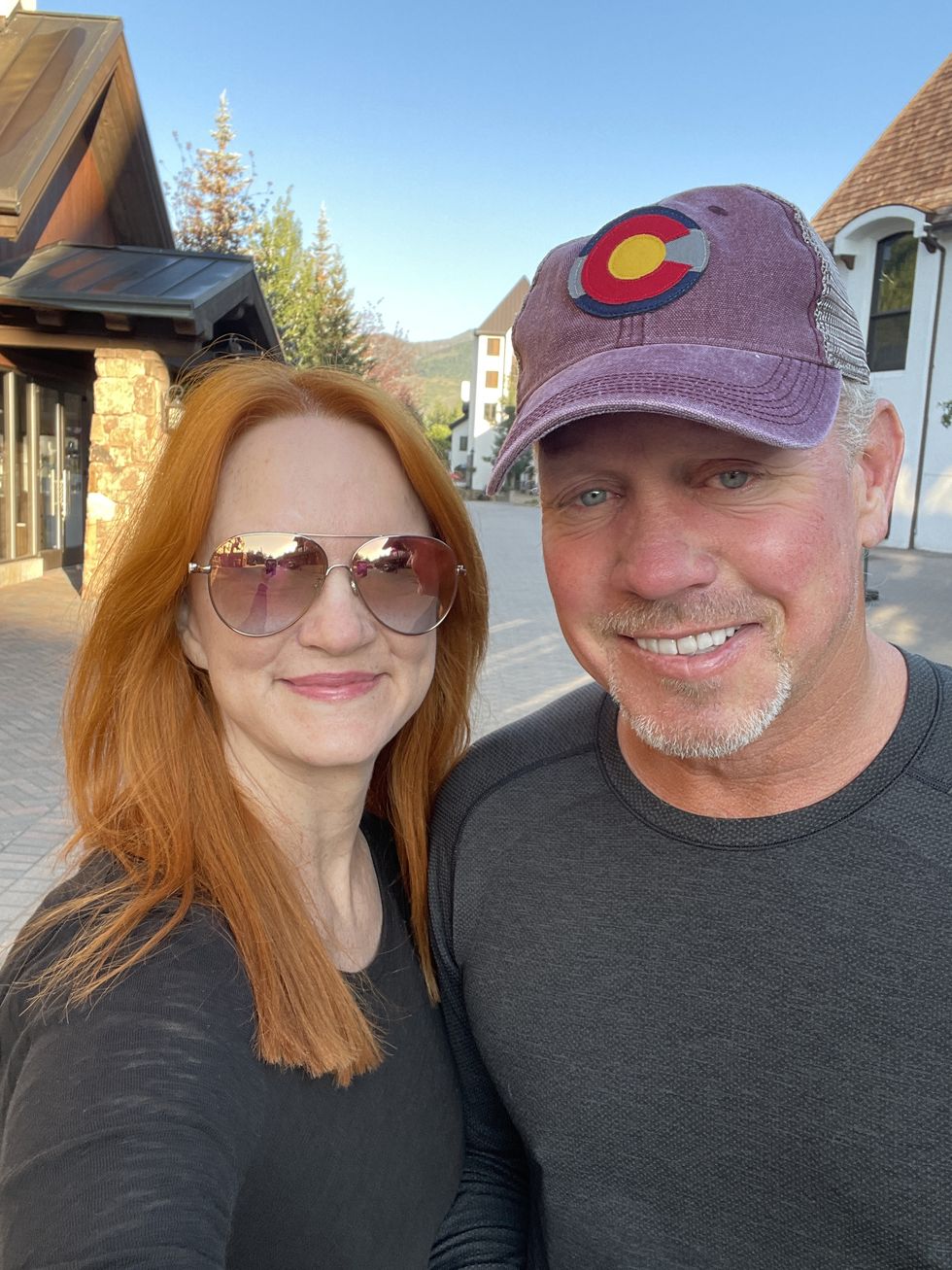

I'm going to share a before and after pic below, not to be critical of myself, and definitely not to suggest that pre-weight loss is somehow "bad" and post-weight loss is somehow "good." But it is helpful for me to see the distance I've come, and to know that the changes have been good for me.

A year ago, my life was comprised of living on the ranch, filming my cooking show, working on cookbooks and my product line, and being a wife and slightly weird mom.

Today, my life is comprised of living on the ranch, filming my cooking show, working on cookbooks and my product line, and being a wife and slightly weird mom.

Only difference between before and after is that I've lost weight. Aside from that, my daily life really hasn't changed all that much.

Or has it?

Today I feel stronger, more in balance (both physically and mentally), and I have more spring to my step. I am wearing clothes I wasn't comfortable wearing a year ago, I feel better about the way I look, and I'm smiling more (yes, even more than I smiled before, which was a lot--haha) and that is a nice feeling at age 53.

After the experience of the past year, I feel better. I have more energy. I'm more motivated to take on projects and put things on the ol' calendar. Feeling good bleeds over into all aspects of my life. And that has changed my outlook.

But to come full circle...it hasn't changed my life itself. I still have cow manure in my yard, for example. It's on top of snow, and it's ruining the dreamy winter vibe. 😂 Gotta go clean that up now, but at least that'll help me get out and move!

I’m a desperate housewife, I live in the country, and I’m obsessed with butter, Basset Hounds, and Ethel Merman. Welcome to my frontier!